Inspire Investment

Indigenously

The Mountain | Plains Regional Native CDFI Coalition (Mountain | Plains Coalition) is a network of mission-driven financial institutions that is successfully deploying capital into previously under resourced rural and Native markets, resulting in job growth and wealth creation. As of 2024, the Mountain | Plains Coalition collectively maintains a 1.32% default rate, which exceeds the national average by three times.

About Us

Community Impact Snapshot

2019 - 2024

461%

INCREASE IN $ LOANS CLOSED

$26.1M

2024 DOLLARS CLOSED

35%

INCREASE IN # LOANS CLOSED

1502

2024 LOANS CLOSED

218%

INCREASE IN JOBS CREATED

955.5

2019-2024 JOBS CREATED

718%

INCREASE IN JOBS RETAINED

1018.5

2019-2024 JOBS RETAINED

Our Members

Please click the logo below for individual Mountain | Plains Coalition members outreach

Four Bands Community Fund

Eagle Butte, SD

People's Partner for Community Development

Lame Deer, MT

Native American Development Corporation

Billings, MT

Montana Native Growth Fund

Hays, MT

Mountain Plains Community Development Corporation

Sioux Falls, SD

Akiptan, Inc.

Eagle Butte, SD

NACDC Financial Services, Inc.

Browning, MT

Plenty Doors Community Development Corporation

Crow Agency, MT

Wind River Development Fund

Fort Washakie, WY

Amplify Strength | Unify Action | Sustain Generations

Beyond Capital: The Story of Native CDFIs and the Buffalo Economy

Across the Mountain | Plains region, Native Community Development Finance Institutions (CDFIs) are leading a powerful shift, one grounded in trust, relationship, and shared power.

This is the Mountain | Plains Regional Native CDFI Coalition.

We invite you to witness what becomes possible when capital follows Indigenous ways of being.

In The News

Fortifying a Robust Indigenous Finance Industry in the Mountains | Plains Region

Brookings Institute | May 21, 2024

Native CDFIs Launch First of its Kind Regional Revolving Loan Fund

Cut Bank Pioneer Press | February 18, 2025

Improving Access to Funding for Indigenous Communities

United States Census Bureau | January 12, 2024

Regional Coalition of 9 Native CDFIs awarded $45M to Support Native Households and Businesses in South Dakota, Montana, Wyoming & North Dakota

Women’s Foundation of Montana | October 21, 2022

Native Leaders from the Mountain | Plains Regional Native CDFI Coalition Reimagine Local Regional Economies from the Ground Up

Northwest Area Foundation | January 31, 2023

Local Governments’ Vital Role in Getting Small Businesses the Funding They Need

Governing | February 14th, 2023

Supporting the Indigenous Finance System on the Mountain Plains

Robert Wood Johnson Foundation | February 23, 2024

Equitable Lending Leaders: Fostering Inclusive Entrepreneurial Lending in Indigenous Communities

Economic Development Administration | November 17, 2023

Client Impacts

“When I talked to Paula Crawford, she was so nice and kind. I got hope again and was ready to do whatever it takes so our family will have a home. Paula was very clear, she explained in detail exactly what we needed.”

- Tommy and Jennifer Heavy Runner, NACDC Financial Services, Inc. Borrower

“I would like to thank Plenty Doors CDC for the programs they provide, and helping the Apsaalooke people in a financial world where your credit score plays a vital role in getting the best out of this life.”

- Charles J. Yarlott Jr., Plenty Doors Community Development Corporation Borrower

“NACDC not only assisted me monetarily but also with financial literacy. It makes me more aware. I am very, very much appreciative in all that NACDC has done for me and my whole family. Thank you.”

– Joleen Weatherwax, NACDC Financial Services, Inc. Borrower

Fortifying the Indigenous Finance Industry

2019 - 2024

$52,998,317*

2022-2024 COALITION INVESTMENTS

*Includes $45,045,817 Economic Development Administration’s Build Back Better Challenge Grant. As of 2022, it was the largest single investment ever made into the Indigenous Finance Industry.

$65.8M

TOTAL PORTFOLIO VALUE IN 2024

379%

TOTAL PORTFOLIO GROWTH

$143.1M

TOTAL NATIVE CDFI ASSETS IN 2024

409%

NATIVE CDFI ASSET GROWTH

121

FULL-TIME EMPLOYEES IN 2024

158%

FULL TIME EMPLOYEE GROWTH

“Every client is different – with a different story to tell and a different path to get to their goal. At the end of the day, we're creating pathways to those solutions and those goals for our communities.”

Tommy Robinson, Four Bands Community Fund, Regional Revolving Loan Fund Manager

Growing Indigenous Economies

2019 - 2024

386

EDUCATION COURSES OFFERED

3492

ATTENDEES OF EDUCATIONAL COURSES

15763

HOURS OF TECHNICAL ASSISTANCE DELIVERED

89%

NATIVE BORROWERS SERVED THROUGH THE EDA RLF

“My favorite part is seeing the younger generations looking up and knowing there’s more they can do — that they can broaden their horizons, do something bigger and better, and help their communities. It’s really cool to watch how even the limited loans I’ve done are making an impact, and it’s incredible to see the younger generations look up and see success.”

Whisper Kelly, People’s Partner for Community Development, Agriculture Loan Officer

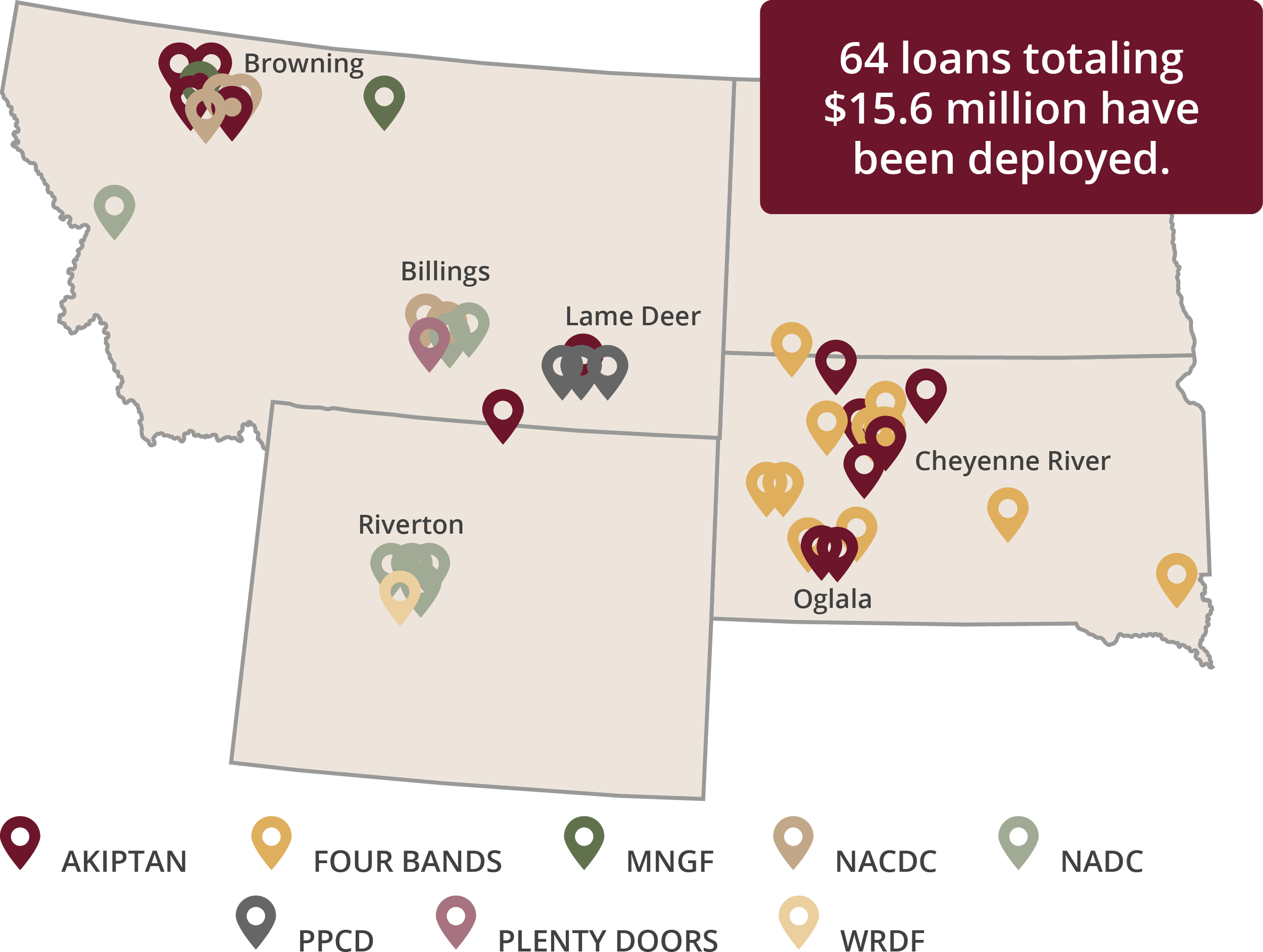

Regional Revolving Loan Fund

First of its kind, the Mountain | Plains Coalition’s Regional Revolving Loan Fund is providing flexible, affordable financing solutions required to transform ideas, market driven research, and informal operations into small business firms that create real economic value.

*As of September 30, 2025

$15,677

AVERAGE LOAN SIZE PRIOR TO RLF (before 2023)

$243,565

AVERAGE RLF LOAN SIZE

1454%

INCREASE AVERAGE LOAN SIZE

90.6%

RURAL MARKETS SERVED BY RLF

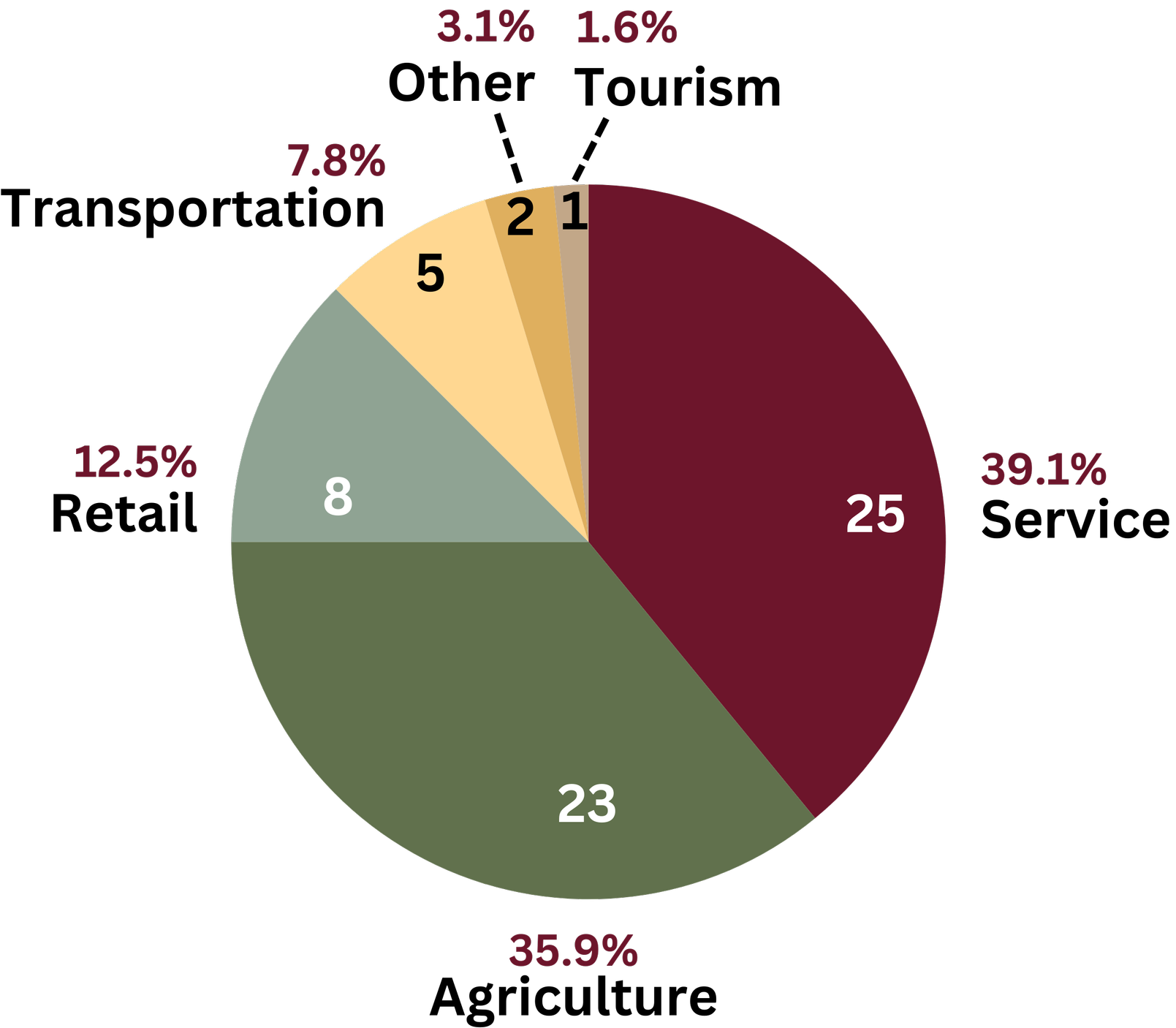

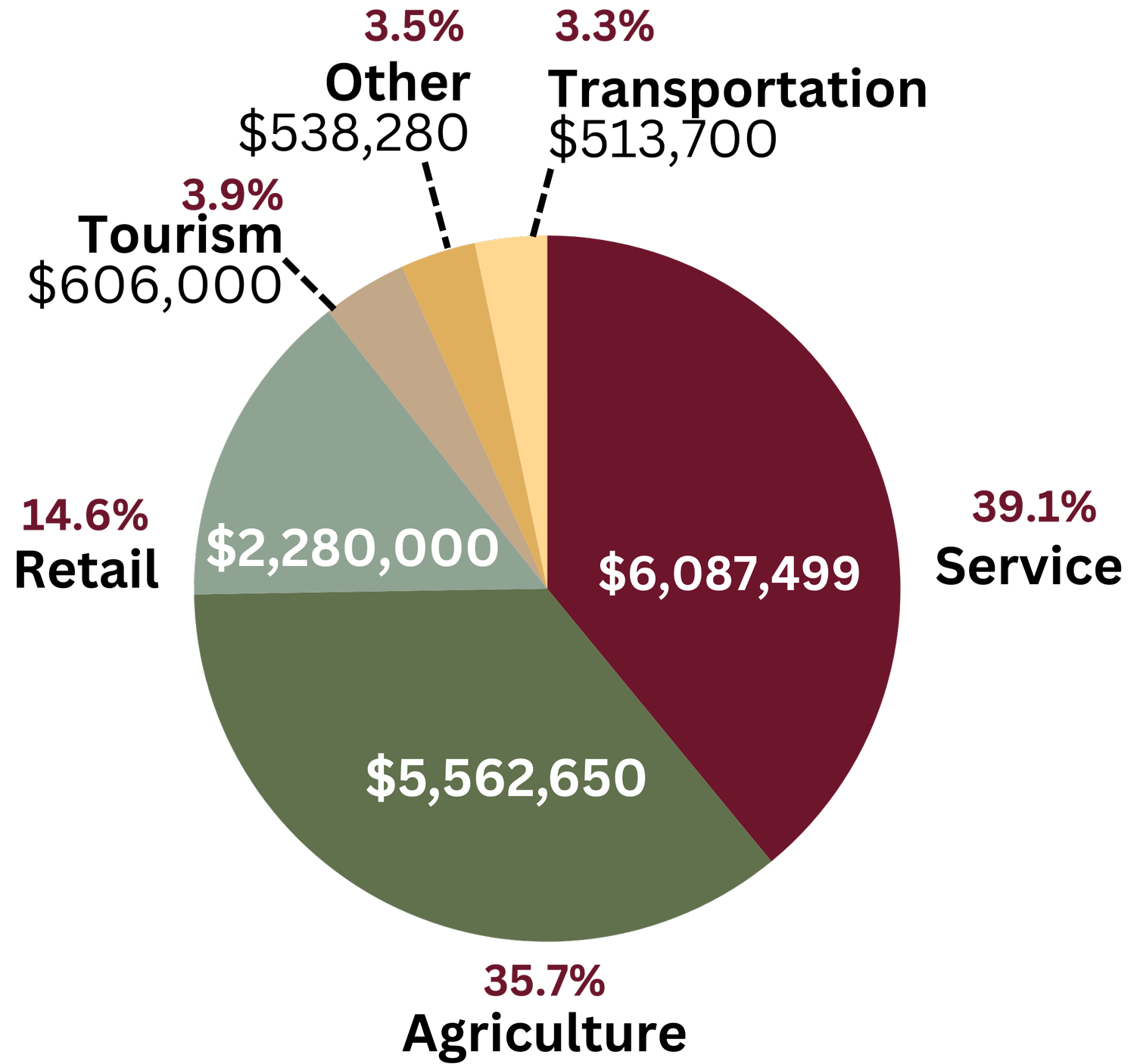

Loan Deployment by Industry

As of September 30, 2025

64 LOANS ALIGNED

$15,588,130 TOTAL RLF DOLLARS ALIGNED

57.8% of borrowers are women

For A Deeper Dive

Debunking Myths: Indigenous Finance in the Mountain | Plains Region

False narratives limit the flow of capital in Native markets. For generations, Indigenous-led solutions have been underestimated or overlooked. The Mountain | Plains Regional Native CDFI Coalition challenges these myths through lived experience, peer-driven strategies, and real data.

Our Partners

Invest | Borrow | Partner

Join Us!

Rooted in relationship and guided by trust, Native CDFIs across the Mountain | Plains region are building financial systems that work for their communities. We invite you to join us in creating a future where capital is led by Indigenous values.